Video game stocks soared last year, and the trend could continue through 2021.

Research firm NPD Group reported that 2020 saw record video game sales. The video game industry generated a total of $56.9 billion. That’s a 27% increase from 2019’s levels.

Activision’s (NASDAQ: ATVI) Call of Duty series and Nintendo’s (OTCMKTS: NTDOY) Switch sales were a big part of the sector’s momentum. Call of Duty: Coldwar was the best-selling game in 2020. Not far behind was Activision’s 2019 release, Call of Duty: Modern Warfare.

The Nintendo Switch was the best-selling console of last year. The Switch’s sales in 2020 were also the best of any console ever in any year.

While global lockdowns, travel restrictions, and stay-at-home orders continue to benefit the industry as well, this isn’t a ‘one-and-done’ trend…

Microsoft’s (NASDAQ: MSFT) earnings report this week showed that its Xbox content and services revenue surged by 40%. Overall, video game revenue soared by 51%.

This is thanks to the massive amount of demand for its Xbox Series X and Xbox Series S consoles. However, the company’s cloud-based video game service, GamePass Ultimate, was also a major contributing factor.

This bodes well for the already-massive video game market, which was estimated to be worth $60.4 billion last year, according to data analytics firm Statista. Reportlinker.com forecasts the growing popularity of video games could push the industry’s value to $256.97 billion by 2025.

That’s a potential 325.4% growth over the next four years…

That’s exactly why I’m bringing you one of the best video game stocks to capitalize on the industry’s momentum. It’s not only one of the leading publishers in the market but also recently received a major tailwind for the long-term.

This Video Game Stock to Watch Landed a Major Deal

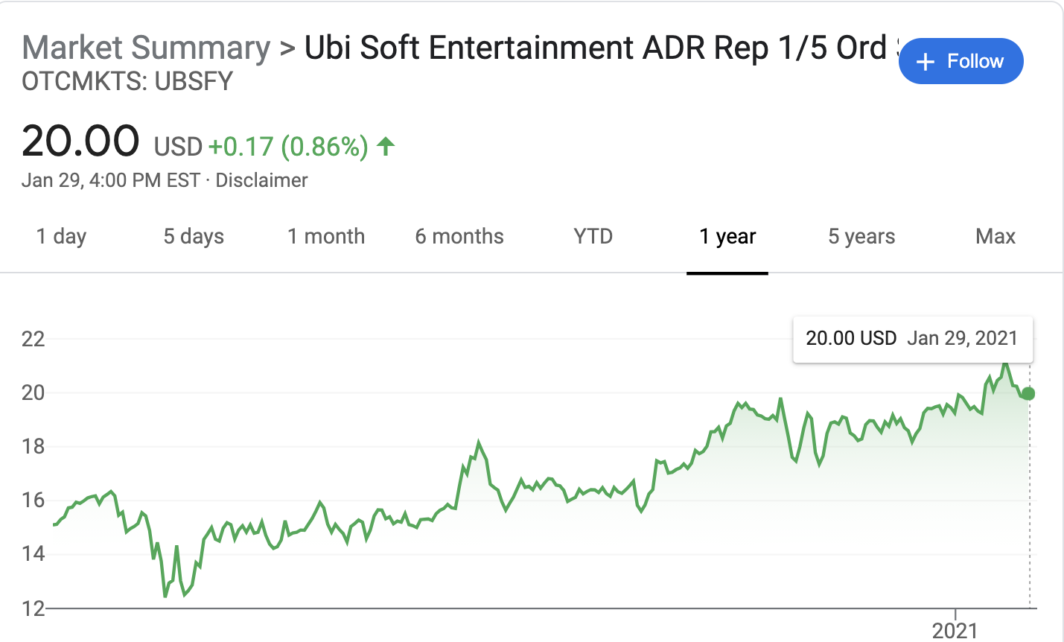

French video game company Ubisoft Entertainment (OTCMKTS: UBSFY) is one of the most popular video game publishers around.

Ubisoft is well known for its major franchises such as Assassin’s Creed, Tom Clancy’s The Division, and Far Cry. However, it’s also the same publisher behind Watch Dogs, the Anno series, and For Honor.

While the company’s portfolio of franchises has made it one of the biggest publishers in the market, its recent deal with Walt Disney (NYSE: DIS) could be a bigger growth catalyst for the long-term. This is especially true considering it’s already developing an Avatar video game for the entertainment giant.

In January, Ubisoft announced a collaboration with Lucasfilm Games, a subsidiary of Disney. The company tweeted it would be developing a “brand-new, story-driven, open-world Star Wars adventure.” This effectively ended competitor Electronic Arts (NASDAQ: EA) exclusive rights to make games under the multi-billion-dollar franchise’s name and signaled that Ubisoft could see further collaborations with Disney in the future.

But this latest tailwind isn’t the only factor that makes Ubisoft a solid company in the market…

In Ubisoft’s latest financial results, the company’s earnings per share were $0.86 compared to the estimated $0.41. The video game publisher’s revenue for the quarter was $918.8 million, greater than Wall Street’s expected revenue of $878.4 million. Ubisoft’s net bookings were $697.5 million versus the anticipated $802.4 million.

Looking ahead to the company says net bookings could continue to rise. Ubisoft said the third quarter’s net bookings could be in the range of $1.04 billion to $1.17 billion. For the entire year, net bookings are projected to be about $2.7 billion to $2.9 billion, with operating income of $509.8 million to $631.15 million.

These results, combined with the company’s Disney deal, as well as the release of new consoles, have pushed several investment banks to raise their price targets. UBS and HSBC both initiated the company’s shares as a “buy.”

This suggests Ubisoft’s existing franchises and future video games could continue to expand the publisher’s profits.

Google Just Poured $4 billion into THIS…

Sponsored

The world’s most successful tech industry giants are all clamoring to get their hands on a new piece of technology.

It’s fresh out of a highly secretive lab in Boston, Massachusetts, and it’s poised to make early investors billions.

It’s NOT cannabis. It’s NOT bitcoin, or some other blockchain-related technology. It’s NOT 5G.

And as a matter of fact, it could be bigger than all of those. Because if history is any indicator, you could be looking down the barrel of 5,000% profits… or even more.

Companies all over the world are funneling as much money as they can into what Bill Gates calls, “the holy grail” of modern technology.

Take a look at some of the top contenders and their spending history:

But Google takes the cake by a landslide. They’ve poured more than $3.9 BILLION into this mind-blowing new tech that’s taking the world by storm.

Click here to see this brand new tech in action, and find out how it could make you 10… 20… even 50 times your money.