CareDx Inc. (NASDAQ: CDNA) healthcare services company that specializes in surveillance solutions for heart and kidney transplant patients.

During the company’s first quarter, CDNA reported earnings per share of $0.01 compared to the expected loss per share of $0.12.

The company’s earnings before interest, taxes, depreciation, and amortization (“EBITDA”) were $7.7 million, greater than Wall Street’s anticipated loss of $600,000.

The firm’s revenue for the quarter was $67.4 million versus the expected $61 million. And CDNA forecasts the positive momentum will continue thanks to the demand for its AlloSure and AlloMap offerings.

This pushed the firm to raise its full year 2021 outlook, noting that revenue could be $270 million to $280 million compared to its previous estimate of $255 million to $265 million.

And given CDNA is more of a hidden gem in the space, with a market capitalization of $3.5 billion, it means it has plenty of room to grow its revenue even higher.

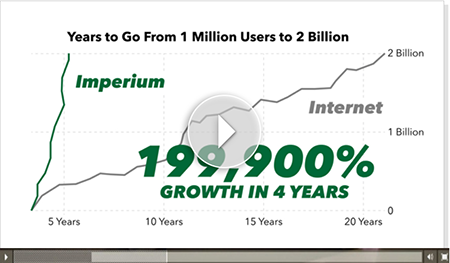

“IMPERIUM:” The No. 1 Investment of the 2020s

Sponsored

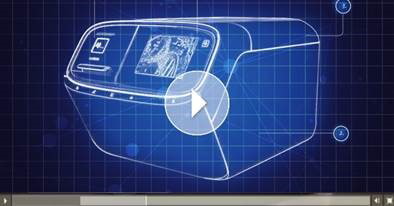

Could this odd-looking machine really be the most transformative innovation in history?

Experts are screaming: “YES”!

Elon Musk calls it “amazing…”

A former Apple CEO says: “[It will] have a far bigger impact on humanity than the Internet.”

While a Harvard Ph.D. says it could “[surpass] the space, atomic, and electronic revolutions in its significance.”

It’s a technology I call “Imperium.” And it’s about to spark the biggest investment mega trend in history … with one small Silicon Valley company at the center of it all.

To get all the details, click here now…