“The future of investing is investing in the future.”

This is the fundamental investment ethos of Cathie Wood, the founder, CEO and CIO of ARK Investment Management LLC.

Ark Invest is an investment firm that ran the largest actively-managed exchange-traded fund (ETF) in 2020, with eye-popping returns of over 150%.

The best part is, we are still in the early stages of high-growth investing as the company only launched its first ETF in late 2014.

ARK’s five actively-managed ETFs focus entirely around disruptive technology, which is changing quicker now than ever before.

They include: the ARK Innovation ETF (ARKK), Autonomous Technology & Robotics WTF (ARKQ), Next Generation Internet ETF (ARKW), Genomic Revolution ETF (ARKG), and Fintech Innovation ETF (ARKF).

Cathie Wood and the team at ARK believe that we are in a period of disruptive innovation, the likes of which we have never seen before.

And wherever there is industry disruption, there is a lot of money to be made for those who invest early on…

Wood and ARK created these five ETFs with the fundamental idea of investing in the highest growth potential companies of our generation.

Here’s why you have to seriously consider investing in them now.

ARK ETFs Are DESTROYING Benchmarks

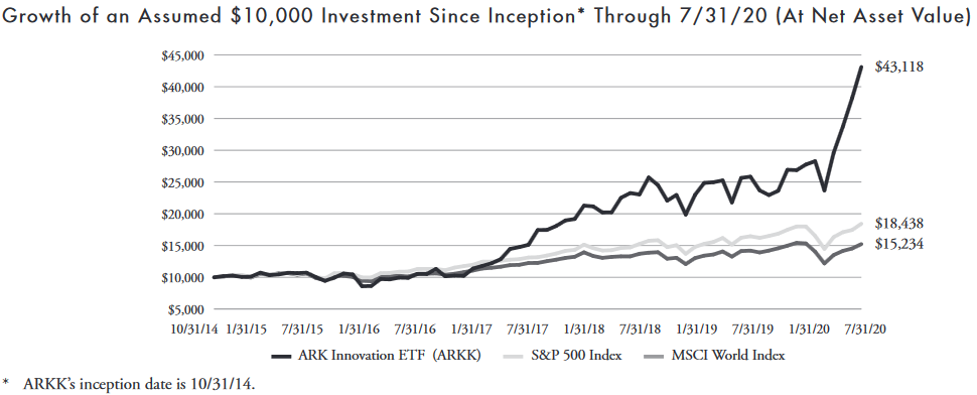

The most diversified of the ETFs ARK offers is the ARK Innovation ETF (NYSEARCA: ARKK).

This fund focuses on investing in companies that develop or create new technological advancements in genomics, robotics, autonomous technology, the next generation internet, and financial technology.

This is ARK’s all-encompassing disruptive technology ETF. If you’re looking for a simplified way to get started with ARK ETFs, look no further than ARKK.

The top contributors to ARKK’s performance have been Tesla (NASDAQ: TSLA), 2U Inc. (NASDAQ: TWOU), Square (NASDAQ: SQ), CRISPR Therapeutics (NASDAQ: CRSP), and Compugen Ltd. (NASDAQ: CGEN).

With these holdings, ARKK more than doubled in value in 2020. And as you can tell from the growth chart above, it’s not just a recent strong performer…

In 2017, the fund rose 87%. In 2019, it rose 35%. This is a demonstration of fantastic active management from Cathie Wood and her team.

Best of all, the ARKK ETF is perfectly positioned to continue outperforming its peers and other benchmarks in 2021 and likely through the decade.

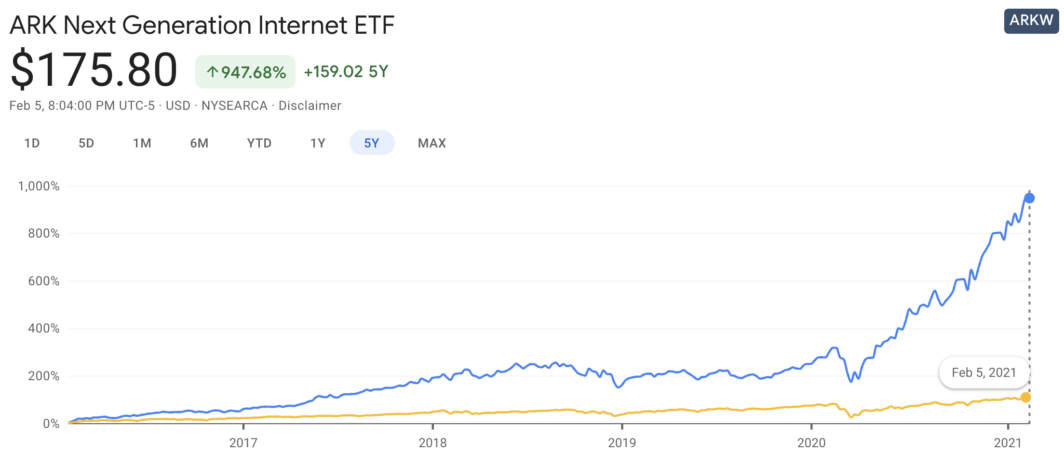

The Best Performing ETF: The ARK Next Generation Internet ETF (ARKW)

Below, you’ll find the performance of the ARKW fund against the S&P 500 and MSCI World Index since inception.

The gains are astonishing…

An initial $10,000 investment in 2014 would be worth $87,300 today.

That’s about 4.5X more than what you would have made owning the S&P 500 – worth only $19,700 over the same timeframe.

In 2020 alone, ARKW’s annual total return was 157%, blowing the S&P’s measly 16% out of the water.

As the name suggests, the investment theme of ARKW is next generation internet.

Here’s what that means…

Internet technology infrastructure is changing and the companies in this fund stand to benefit from these changes.

They may develop, produce or enable technologies like cloud or mobile computing, cyber security, big data, artificial intelligence (AI), or blockchain.

You’ve likely heard of these technologies before, with people telling you they’re game-changers…

Maybe you don’t consider yourself to be an overly tech-savvy person, and therefore don’t feel comfortable enough picking individual tech stocks for your portfolio.

And that’s a smart move. After all, Warren Buffet has always preached to invest only in what you know…

So, what do we know about ARK ETFs? Demonstrated performance. Results. Gains. Crushing traditional benchmarks. Great active management.

Let ARK do the heavy lifting of picking the individual stocks and allocations, while you sit back and watch the profits roll in…

What Lies Ahead for ARK ETF Investments

Now, we all know that past performance of any security or ETF does not guarantee future results…

But this idea is exactly what lies at the core of ARK’s investment strategy.

They don’t invest in what has been successful in the past. Instead, Wood and her team are always looking to invest in companies driving future innovation in the market.

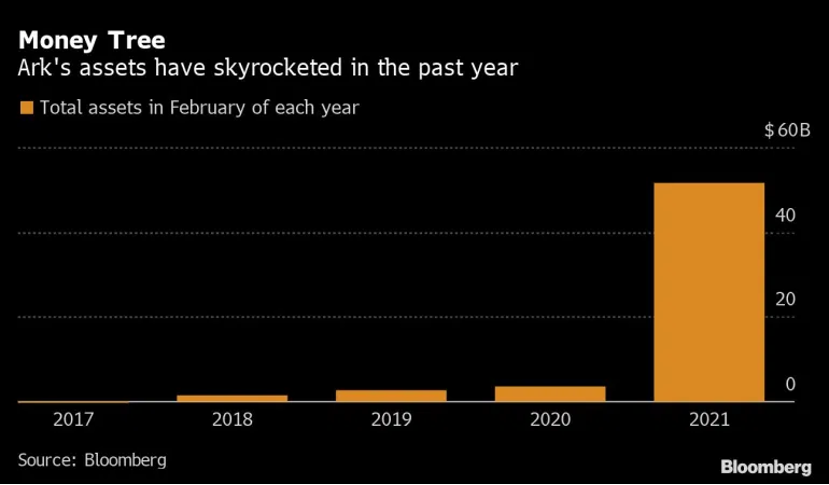

With this philosophy at heart, ARK’s assets under management have skyrocketed in the past year.

I don’t see anything stopping their growth. Cathie Wood has the hot hand on Wall Street and plans to keep it that way.

It’s easy to see how she earned the nickname, “돈나무” in Korean, which loosely translates to “Money Tree” in English.

She has an approachable persona, attracting investors of all experience levels.

The team she constructed at ARK consists of not only financial and economic analysts, but also employees with technical subject matter expertise (like computer scientists and computer engineers).

This blend of diversified personnel puts ARK at the very top of the best-positioned management firms in 2021.

It’s not too late to capitalize on ARK’s ETFs.

On January 20, 2021, CNBC reported that Wood expects ‘explosive’ earnings in 2021 as companies continue to bounce back from the pandemic recession.

Additionally, ARK recently filed plans for the ARK Space Exploration ETF (ARKX), which will track U.S. and global companies engaged in space exploration and innovation.

I hope you packed your space suit because you may figuratively, and literally, be headed TO THE MOON with ARK ETFs.

Google Just Poured $4 billion into THIS…

Sponsored

The world’s most successful tech industry giants are all clamoring to get their hands on a new piece of technology.

It’s fresh out of a highly secretive lab in Boston, Massachusetts, and it’s poised to make early investors billions.

It’s NOT cannabis. It’s NOT bitcoin, or some other blockchain-related technology. It’s NOT 5G.

And as a matter of fact, it could be bigger than all of those. Because if history is any indicator, you could be looking down the barrel of 5,000% profits… or even more.

Companies all over the world are funneling as much money as they can into what Bill Gates calls, “the holy grail” of modern technology.

Take a look at some of the top contenders and their spending history:

But Google takes the cake by a landslide. They’ve poured more than $3.9 BILLION into this mind-blowing new tech that’s taking the world by storm.

Click here to see this brand new tech in action, and find out how it could make you 10… 20… even 50 times your money.