A 10,000% Dividend?!?

Sponsored

Have you seen this strange oil investment? It's NOT a stock, bond, or private company… It has NO age requirements… You do NOT need to be accredited to participate… And you can get in for as little as $25. Yet this secret is so powerful that one man used it to build a $100,000 income stream from just $1,000. And he was collecting this income even 50 years later! That's like earning a 10,000% dividend year after year! In short… This is easily the #1 Oil Play for 2023 and beyond. My short presentation reveals everything: Get the Details of This Special Income Play Here

Let me tell you, there's nothing quite like the beauty of passive income.

It's the holy grail of financial freedom, and the dream of every savvy investor out there.

Picture this: money flowing into your bank account like a steady stream, even while you sleep or sip cocktails on a sandy beach. Sounds too good to be true, right?

Well, think again! Achieving passive income is not just a distant fantasy reserved for the wealthy elite; it's an attainable goal that can be easily accomplished with the right strategies and mindset.

Today, I'm here to share 5 of the best passive income strategies and show you the incredible ways you can make it work for you.

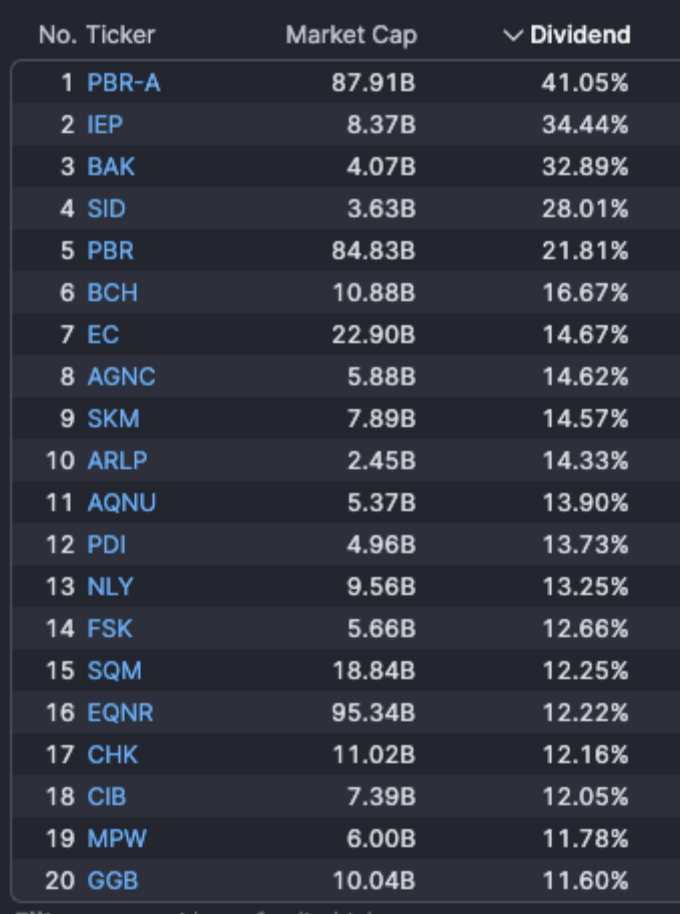

1. Dividend stocks and funds

Dividend stocks are shares of companies that pay out a portion of their profits to shareholders on a regular basis. Dividend funds are baskets of dividend stocks that can be a more diversified way to invest in this asset class.

Our Top Picks:

2. High-yield savings accounts and CDs

These accounts offer higher interest rates than traditional savings accounts, which can generate some passive income. However, your money will be locked up for a certain period of time, so you'll need to be prepared to not touch it.

Our Top Pick: SoFi Checking and Savings, Current APY 4.50%

3. Real estate investment trusts (REITs)

REITs are companies that own and operate income-producing real estate. They can be a good way to invest in real estate without having to deal with the hassle of owning and managing properties yourself. By law and IRS regulation, REITs must pay out 90% or more of their taxable profits to shareholders in the form of dividends.

Our Top Picks:

4. Peer-to-peer lending

Peer-to-peer lending platforms allow you to lend money to individuals or businesses directly. This can be a way to generate passive income, but it's important to do your research and only lend to borrowers who are likely to repay their loans.

5. Royalties

Royalties are payments made to an individual for the ongoing use of their assets, including intellectual property (music, books, and software), franchises, and natural resources. Royalties can be a good source of passive income, but they can also be difficult to obtain.

6. Bonus Pick: IRS loophole allows ANYONE to collect up to $28,544 before Sept. 10th

IRS loophole allows ANYONE to collect up to $28,544 before Sept. 10th

Sponsored

These folks got it made!

Thanks to a little-known IRS loophole…

They are collecting huge payouts from government-regulated “royalty programs”… every single year!

“Started from a zero balance… Just hit $1,200 a month in [royalties].” -Neil P.

Like Neil P., who is now collecting $1,200 a month in “royalties.”

“Increased my [royalties] to over $30,000 last year.” -Tom K.

Tom K. reports he's making $30,000 a year!

“Increased my [royalties] from about $2,000 to $60,000…” -Elaine T.

And Elaine T. boosted her payouts to $60,000 per year!

If you want to participate, you'd better hurry.

The next payout deadline is coming fast.

Learn how to collect your first payout before September 10th.