Everything we’re looking at is telling us that the bear market is over and it's time to buy the dip…

- 2022’s pain is about to turn into 2023’s gain. So, the smart money is putting themselves in position today.

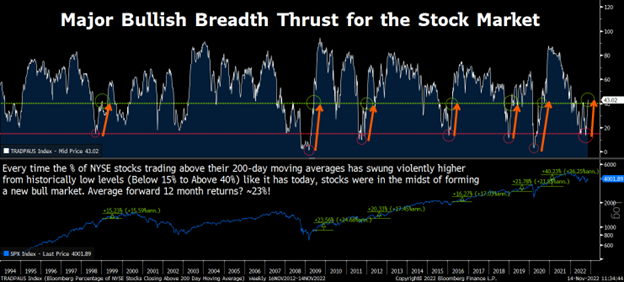

- Last week’s buying pressure was so immense that the stock market flashed an ultra-rare technical indicator that I call the “Bear Market Ender.”

- It flashes when the percent of stocks on the New York Stock Exchange trading above their 200-day moving average swings violently from very low levels to more normal levels – from below 15% to above 40% within a matter of weeks or less.

- Such violent swings higher are very rare. They’ve only happened six times over the past 30 years. In each of those six instances, stocks were in the midst of going from a bear to a bull market and always soared over the next year.

All bear markets eventually turn into new bull markets. And an overwhelming amount of evidence today suggests the 2022 bear market is about to turn into a 2023 bull market.

Stocks crashed in 2022 because of a confluence of adverse macroeconomic trends. Inflation soared. The Fed aggressively hiked interest rates. Fixed income yields soared. Corporate profit margins got squeezed.

Those are the sorts of trends that tend to hurt stocks and in 2022, they all came together at once. No wonder stocks got crushed!

But in 2023, the stage is set for all those trends to reverse course.

Inflation will crash. The Fed will respond by stopping its rate-hiking campaign. Bond yields will consequently fall. And as companies look to aggressively cost-cut, corporate profit margins will expand. (Notice all the layoff announcements recently?)

As all that happens, stocks will soar in 2023 – and I’m not the only one who sees things this way.

Why else do you think the S&P 500 had one of its best days ever last week? Why did tech stocks put together one of their best short-term rallies ever last Thursday and Friday? Or why do you think hypergrowth stocks actually did put together their best short-term rally to end last week?

The smart money sees the writing on the wall. Indeed, 2022’s pain is about to turn into 2023’s gain. So, the smart money is putting themselves in position today. They’re buying big.

In fact, they’re buying so much that last week, a super rare technical indicator flashed. It’s one that only emerges when a ton of investors rush to buy the dip in stocks. And every time it has flashed in the past, it has marked the end of a bear market and the start of a new bull market.

This time will prove no exception. The end of the 2022 bear market has likely arrived. A new bull market could be forming. Investors who take advantage today could make fortunes over the next year – and we have the best way for you to take advantage right now.

Here’s a deeper look…

The “Bear Market Ender

Last week, the stock market soared after October inflation numbers came in much lighter than expected and sparked hopes that inflation is finally dying.

The buying pressure was immense. On Thursday, for example, the S&P 500 rallied more than 5.5% to mark one of its best days ever. The Nasdaq rose even more, climbing more than 7%.

Indeed, last week’s buying pressure was so immense that the stock market flashed an ultra-rare technical indicator that I call the “Bear Market Ender.” This indicator only appears when investors buy the dip so hard that it actually marks the end of the bear market.

I’m talking about a bullish breadth thrust indicator. Specifically, it flashes when the percent of stocks on the New York Stock Exchange trading above their 200-day moving average swings violently from very low levels to more normal levels. Quantitatively, that’s when the percentage swings from below 15% to above 40% within a matter of weeks or less.

Such violent swings higher are very rare. They’ve only happened six times over the past 30 years.

But they’re also incredibly bullish. In each of those six instances, stocks were in the midst of going from a bear to a bull market. They always soared over the next year. Average return? Above 20%.

Well… this indicator just flashed for the first time since the market was rallying out of the COVID-19 pandemic scare.

Over the past few weeks, the percentage of stocks in the market trading above their 200-day moving average has swung from below 15% to above 40%.

History says that what comes next is the end of the bear market, the start of a new bull market, and a 20%-plus stock rally over the next 12 months.

We aren’t going to argue with history on this one. It lines up with the fundamentals, the trading action, the technicals – everything.

Stocks are positioned to soar over the next year. But are you positioned to take advantage of this record rally?

The Final Word

I cannot emphasize this enough: Everything we’re looking at today is telling us that now is the time to buy the dip.

Every day, we look at dozens of fundamental and technical market indicators. We’ve found more than a handful with perfect track records of calling bear market bottoms. And pretty much all of them are flashing right now.

The implication is that the bear market is basically over. Up next? A multi-year bull market that jumpstarts in 2023.

The time to buy is now.

And if you’re looking to buy, we have the perfect stock for you.

Where to invest $50 right now…

Sponsored

Before you consider trading any of the stocks in our reports, you'll want to see this.

Investing Legend Ross Givens just revealed his #1 stock for the rest of 2022.

And it's not in any of our reports…

After managing hedge funds for one of the world's largest banks, he's decided to go “all-in” on the one stock that could make investors rich in 2022.

You can view it on Mr. Givens' website, here.

Wondering what stock I'm talking about?

Click here to watch his presentation and learn for yourself.

But you have to act now because a catalyst coming in a few weeks is set to take this stock mainstream… And by then, it could be too late.