See An-E's stock price predictions of TSLA, NVDA, and AAPL

Sponsored

One of the world's top financial tech companies recently launched a breakthrough, new A.I. stock predictive system called An-E (pronounced Annie, short for Analytical Engine).

They tested it by tasking it with many thousands of stock predictions… and comparing its forecasts with what actually happened.

And many of those predictions ended up being incredibly accurate, often times either spot on or only a percentage or two off.

That was one of the main reasons TradeSmith knew they could bring An-E to the market, and show its capabilities to the public…

Which we did recently by putting on a special presentation.

During that event, TradeSmith had An-E “take aim” at some of the biggest, most popular stocks on the market… Tesla (TSLA), Nvidia (NVDA), and Apple (AAPL)…

And predict their stock prices one month into the future.

Well, where did An-E think they would end up?

The answer was pretty shocking.

You can find out for FREE, here.

When it comes to buying and selling stocks, we’re too often our own worst enemy.

Emotion is a killer.

We abandon perfectly sound (but boringly steady) stocks to buy sketchy penny stocks that are more “interesting.”

We get infected with “FOMO” – a fear of missing out – and chase already-hot stocks up past unsustainable highs.

We finally manage to pick a winner but overstay our welcome and fail to sell once that “smart move” loses steam.

That’s why artificial intelligence (AI) can be such a powerful investing tool.

It lacks emotion…

It doesn’t get afflicted with “following the herd.”

It doesn’t get stuck in its “own head.”

And it avoids “paralysis by analysis.”

As a fine-tuned algorithm, AI can bolster your decision-making process.

It’ll find the winners. And it’ll avoid the losers.

And we’re going to use TradeSmith’s AI algorithm as a real-time case study.

That’s why I want to talk about the car rental company Avis Budget Group Inc. (CAR).

Budget Cars and Higher Stock Prices

In a note to clients on Tuesday, analysts at the heavyweight Wall Street investment bank Morgan Stanley boosted their price target for Avis from $182 to $230 per share.

The fuel for their bullishness stems from the company’s ability to:

- Rev up revenue.

- Slash operating costs.

- And pull of the 2x dynamic of using that higher top line and lowered costs to “out-margin” its rivals.

This boosted price target boosted the CAR share price Tuesday: The stock opened at $213.70 and closed at $224.14 – a 4.8% gain on the day.

And the results over the last month have been even more impressive…

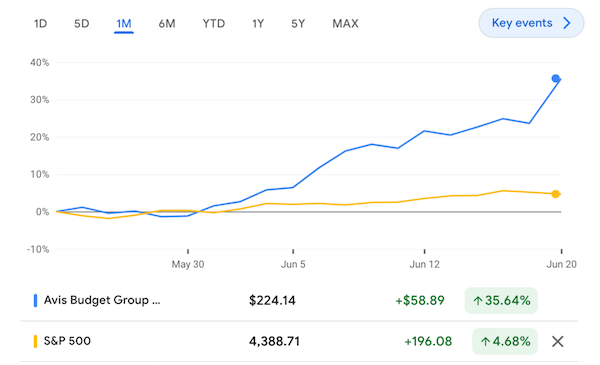

CAR has climbed 35% as of this writing, which is nearly nine times higher than the returns of the S&P 500 over the same time period:

Source: Google Finance Seeing that rapid price rise – and throw in the stock shellshock of 2022 most people are still trying to recover from – and you can see why folks could come down with a case of “Avis FOMO.”

After all, how can you lose when Wall Street dangles a chance to make money?

But that’s the trap that retail investors fall into time and time again. They will buy high into a company they don’t really understand or know much about, those who got in earlier will start taking profits, the stock price will drop, and those FOMO-infected Johnny-come-latelies will get stuck with a loss.

And most likely sell.

That’s why our Predictive Alpha suite of services, powered by our AI-driven stock forecasting system we call An-E, is such a powerful tool against battling emotional investing.

The Outlook from An-E

The power of An-E is that it is always learning from new information, so its predictions will evolve as it processes new data.

But as it has been analyzing data on Avis over the last few days, it did not have as favorable of an outlook for Avis in the month to come.

An-E has placed a “Neutral” outlook on Avis, predicting as of this writing (please note that An-E is constantly analyzing data and updating information) that CAR will rise less than 1% by July 20:

What this type of information provides is an investing “gut check” to help you before running out and acting on impulse.

With double-digit gains already over the last month, what An-E is predicting is that the stock price may slightly climb but is starting to cool from the blistering pace of its gains over the last month.

Bottom line: Whether up, down, or stuck in neutral, An-E can predict where the next stop may be for a stock price. And by combining this smart AI tool with your own current research, you can see how you can take things to the next level and keep your emotions in check when investing.

New incredibly accurate A.I. system predicts Tesla's stock price

Sponsored

Just recently TradeSmith, one of the world's most cutting-edge financial tech companies, rolled out a brand-new A.I. predictive system called An-E which stands for Analytical Engine.

TradeSmith is also giving folks a “sneak peek” of some of An-E's predictions, so you could see what it's capable of for yourself.

Here's one of them…

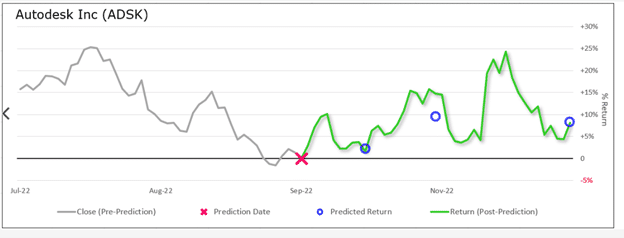

This chart of a company called Autodesk:

Here you can see a red X. That's when An-E made its prediction about where Autodesk's stock price would go…

And those blue circles represent An-E's predictions two weeks, one month, and two months into the future.

Well, here's what actually happened with Autodesk's stock over the next two months…

As you can see, An-E's forecast is almost spot on…

If you would have invested based on its predictions… you would have made nearly 15% in a month.

Here's another one…

This is Carnival, the cruise line company.

Again, we see the blue circles representing An-E's predictions…

And here's how Carnival's stock played out…

And those are just two examples from a test they ran. TradeSmith has dozens more, including a prediction An-E just made about Tesla's stock.

You can get all the details behind An-E, including its latest prediction about Tesla by going here.

I think you'll be surprised by where An-E says Tesla's heading.