FedEx Corp. (FDX) is an American multinational transport and package-delivery company based out of Memphis, Tennessee.

And over the past two years, the shipping company has seen a major uptick in demand…

With people continuing to work and attend school from home, many consumers have grown reliant on e-commerce for their shopping needs. Because of this, demand for FDX’s shipping services surged.

However, given the ongoing labor shortage and rising supply-chain costs, FDX reported mixed quarterly results.

In the first quarter, the company said earnings per share were $3.37 compared to the anticipated $4.88. FDX reported revenue of $22 billion as well, which was slightly higher than the estimated $21.93 billion.

These factors caused shares of FDX to fall over the past several weeks. But this selloff may have been an overreaction from the market…

In its press release, the company highlighted that many of the disruptions it faced were offset by package revenue, international demand, and domestic express package volumes.

And despite FDX’s mixed earnings, one of its biggest issues is the fact that the company is faced with overwhelming demand. This is a trend that is unlikely to end anytime soon, as the company plays a pivotal role in the online shopping space.

So, any present volatility in FDX’s share value may simply be a temporary problem for an otherwise thriving business.

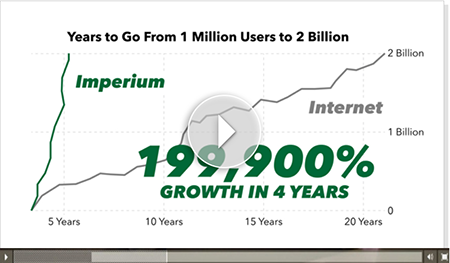

“IMPERIUM:” The No. 1 Investment of the 2020s

Sponsored

Could this odd-looking machine really be the most transformative innovation in history?

Experts are screaming: “YES”!

Elon Musk calls it “amazing…”

A former Apple CEO says: “[It will] have a far bigger impact on humanity than the Internet.”

While a Harvard Ph.D. says it could “[surpass] the space, atomic, and electronic revolutions in its significance.”

It’s a technology I call “Imperium.” And it’s about to spark the biggest investment mega trend in history … with one small Silicon Valley company at the center of it all.