Tiny $3 AI Stock Primed to Skyrocket

Sponsored

During his time as a Vice President for a major Wall Street bank… Ross Givens exploited his privileged position to help make his clients filthy rich. That was his job. Today, he's re-deploying this knowledge to help the ordinary Joe unlock the most explosive moneymaking opportunity in America. It centers on an extraordinary “$3 AI Wonder Stock”… This single stock gives you the opportunity to “lock in” the retirement of your dreams… Who knows? Perhaps even set you up for millionaire status. It will blow your mind. You can get the full details here in his new video. But hurry… Things are moving super-fast. The longer you wait, the more returns you could be giving up… Go here ASAP to find out more about this “$3 AI Wonder Stock”.

By Ross Givens

As expected, it was a down week for the markets.

This is a good thing.

Chart of the Day

We all love when stocks go up. But if they go straight up for too long, it is only a matter of time before prices correct harshly.

Stocks were on a 9-week streak before last week. That is almost unheard of.

The market needs time to digest this rally, absorb the sellers, and set up for the next move higher.

As you can see from today’s chart, the best gains come from clean breakouts out of shallowing compression patterns.

The chart of the Russell 2000 index breaking out in December is my go-to chart pattern when looking for institutional buying.

The more you can spot this pattern in your trading, the more successful you will be.

Insight of the Day

The more you can boil your strategy down to its core fundamentals, the more you can adapt it to changing market conditions.

The process for finding high returns is simple:

- Strong market

- Strong group

- Strong stock

At the start of December, crypto and home construction were the strongest areas of the market.

So that’s where we focused our efforts, giving people the chance at gains like 24% in 15 days, 54% in 37 days, and even 94% in four weeks.

Right now, home builders, biotech, and banking are the leading groups. So that’s where we’ll be targeting.

If the market stays weak, all we’ll do is trade smaller. But we’ll still focus on the leading stocks in the top-performing groups.

That’s how we adapt our strategy to shifting market conditions. Maintain core fundamentals while adjusting position sizing and risk management.

That’s how the best traders in history do it. And that’s how I do it.

There's a huge opportunity in 2024 if you stay focused on the fundamentals.

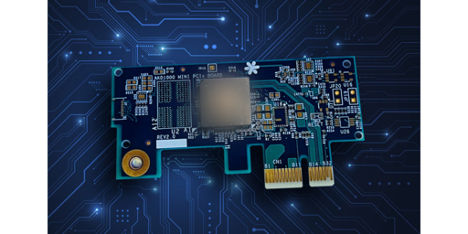

Is this tiny $2 stock the next NVDA?

Sponsored

Is this little known chipmaker the next NVDA?

It has nothing to do with AI, but this company's patented chip could generate NVDA sized gains in the coming months…

This one RIGHT HERE…

How can I say that with such certainty?

Because the most powerful tech companies in the world are SCRAMBLING to be the first to market with this new technology…

Companies like Microsoft, Intel, and Google are all quietly racing to be at the forefront of this new phenomenon…

But unfortunately for them…

This one small company holds the key to this revolution…

And they already have 12 patents to protect their groundbreaking innovation from copycats…

>>Click here to see why this small company won't be small for long.

-Tim Bohen