The biotechnology industry is one of the most important industries in the world.

That’s especially true today as the world is finally starting to come back to normal thanks to the much needed COVID-19 vaccines.

But just because coronavirus has gotten most of the headlines over the last year, that doesn’t mean other diseases and biotechnical problems have stopped happening altogether…

In fact, I feel like they’re being more overlooked now than ever.

That’s why I think investors should be scooping up these top three biotech stocks before Wall Street catches on…

Here they are:

#3 Twist Bioscience Corp. (NASDAQ: TWST)

Founded by two DNA synthesis technologists in 2013, Twist Bioscience Corp. works in medicine, agriculture, industrial chemicals, and data storage to change the world with its proprietary synthetic DNA tools.

The company's mission is to help its customers develop ways to better all life and improve the sustainability of the planet.

And just this week, TWST was been named to Fast Company’s prestigious annual list of the World’s Most Innovative Companies (MIC) for 2021.

#2 EXACT Sciences Corp. (NASDAQ: EXAS)

According to its website, Exact Sciences is changing the way we think about detecting and treating cancer. As a leader in cancer testing, the company is committed to providing earlier answers and life-changing treatment guidance.

Shares have experienced steady growth over that last year that I expect to continue into 2022.

Check out its stock chart below:

The Biggest Drug Ever

Sponsored

In October 2013, a scientist wrote three words down on a piece of paper.

They were simple words. A five-year-old could say them.

But these words hold the key to a new breakthrough the Economist says would be “A boon to humanity.”

And CNBC says, “Would help tens of millions of people.”

He began to tell fellow scientists the three words. And his ideas for them.

He soon recruited a team that's been called “the best scientists on earth.”

Then he started telling investors about them.

In May 2015 Fidelity Biosciences cut him a check for $217 million, along with an investor group.

In August 2016, he told Jeff Bezos the three the words. He walked out with a check for $130 million.

It took just over a year – 390 days – for his company to hit a $1 billion valuation. That's faster than any company in history, including Facebook.

All because of three words. Words that all happen to start with the letter “B.”

Discover the 3 words behind “the biggest drug ever” >>>

How is that possible?

It's because the three words hold the key to a new treatment Jim Cramer says would be “the biggest drug ever.”

A treatment that experts predict could help as many as 50 million people…and save the United States $20 trillion in medical costs.

Any company that harnesses this treatment will thrive.

Which is why a Big Pharma giant bought 11.2% of this small firm's stock last year.

If you follow the lead of Bezos, Fidelity and the Big Pharma giant, you can lock in your stake in this firm today…

And watch three words turn a $1,000 investment into more than $1.1 million.

You have every right to be skeptical…

But when I show you the three words and what they mean…

You'll understand why so many people are rushing to back this visionary entrepreneur…

And why The Wall Street Journal says, “The financial benefits would be massive.”

These three words could do more than just make you rich.

They can change how we treat one of the cruelest diseases on earth.

Discover the 3 words behind “the biggest drug ever” >>>

My #1 Biotech Stock to Own Today…

Steve Cohen, the legendary billionaire stock picker known for delivering huge returns for his clients at SAC Capital – one of the most successful hedge funds ever – is at it again.

But this time, he's doing it with his new company Point72 Asset Management – which manages $17.2 billion for high-net-worth individuals.

Even if us normal folks can’t invest in the Point72 fund itself, we can still copy Cohen’s trades…

You see, Point72 is required to disclose all its holding publicly every quarter.

And last quarter, Cohen’s firm revealed a new position in one penny stock that caught my eye.

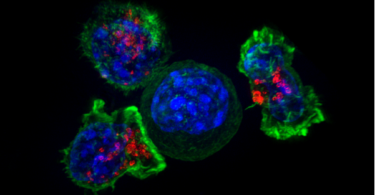

Cocrystal Pharma is a clinical stage biotechnology company discovering and developing novel antiviral therapeutics that target the replication machinery of influenza viruses, hepatitis C viruses, and noroviruses.

The company employs structure-based technologies and Nobel Prize-winning expertise to create first-and best-in-class antiviral drugs.

COCP is currently developing an oral broad-spectrum replication inhibitor called a non-nucleoside inhibitor – which is currently being evaluated in a Phase 2a study for the treatment of hepatitis C as part of an ultra-short therapy of four to six weeks.

Now if you don't know what any of that means, it doesn't matter. All you need to know is that it's huge for the treatment of some of the world's most-killer diseases… and potentially for investors too.

The stock shot up from $0.87 to $2.16 after Cohen announced his stake in the company late last year.

But now that’s it’s down to only $1.14 per share, that makes Cocrystal Pharma one of the more interesting penny stocks to watch for potentially huge gains in 2021.

If those Phase 2 trials turn out successful and the company moves on to Phase 3, the stock should get a boost. And if Phase 3 is successful, the stock could soar.